Financing a Fair Transition:

Inside 103’s Work with the Just Transition Finance Lab

by Kate Wolfenden

The context: just transition finance - where are we?

There’s no doubt about it, transitioning to a sustainable economy is a sizable investment. While there is no single source of truth, a suite of globally credible sources converge on the undeniable message that we are facing multiple trillions of annual needs to deliver on our net-zero pathway.

And our progress in plugging that gap? Using Climate Policy Institute (CPI) as an example, we are gathering speed, but we are approximately 80% below where we need to be. (Estimated at $8-9T/yr through 2030 rising to over $10T/yr in 2050, CPI) with observed climate finance flows of $1.9 trillion in 2023 and early data indications of over $2 trillion in 2024 (CPI).

What then for progress on just transition finance? Quantifying this gap becomes even more challenging when we consider the “just” dimension of the transition. Just transition finance ensures climate action supports workers, communities, and vulnerable groups. While it aligns net-zero goals with social outcomes such as decent work, regional equity, and poverty reduction, it weaves two critical important finance themes together; but in the process, risks losing itself.

What makes assessing progress on just transition finance enduringly difficult is a perfect storm of a lack of political mandate and resultant scrutiny, lack of practitioner understanding, alignment and integration (across both public and private sectors), and insufficient influence from affected stakeholder to break through into commonly understood and accepted practice; such enabling conditions could trigger the critical mass of underpinning infrastructure needed to enable this investment theme to flourish. Instead, what we are experiencing is deep fragmentation; of concepts and definitions, of principles and practices, and of metrics and mandates.

The result? Growing stagnation, in the face of mounting headwinds and retrenchment. For a concept with the potential to transform our collective efforts toward a socially and environmentally balanced transition, current financial flows remain critically below what this critical decade requires.

The case for the financial sector to support the just transition is well-established at a concept level, across investors, banks, and multilateral development banks. The challenge is no longer why, but, how.

At 103, we like to think to zoom in and zoom out on these moments. Go deep into the detail of what exactly the people the key stakeholders are thinking, feeling and doing, and look at it from a macro and longer term view. This is our view on just transition finance today, and how we are considering making a small but meaningful contribution to its trajectory.

This is how we arrived in the just transition finance space last year, thanks to the support of Laudes Foundation and the partnership with the London School of Economics’ Just Transition Finance Lab. Our focus? To consider where and how deliberate convenings can support the maturation and acceleration of the just transition finance movement.

In pursuit of this insight we were afforded a small budget to map the landscape of key stakeholder needs and five complementary workstreams have emerged out of, or in association with, this work. These are already an example of niche innovations beginning to cluster, helping the field advance, but they are not the focus of this article. You can read more about them in our Q&A with Gemma.

Today, our focus is Workstream 3: Integrating just transition outcomes into the GSS+ bonds landscape.

The challenge: 103 x just transition finance

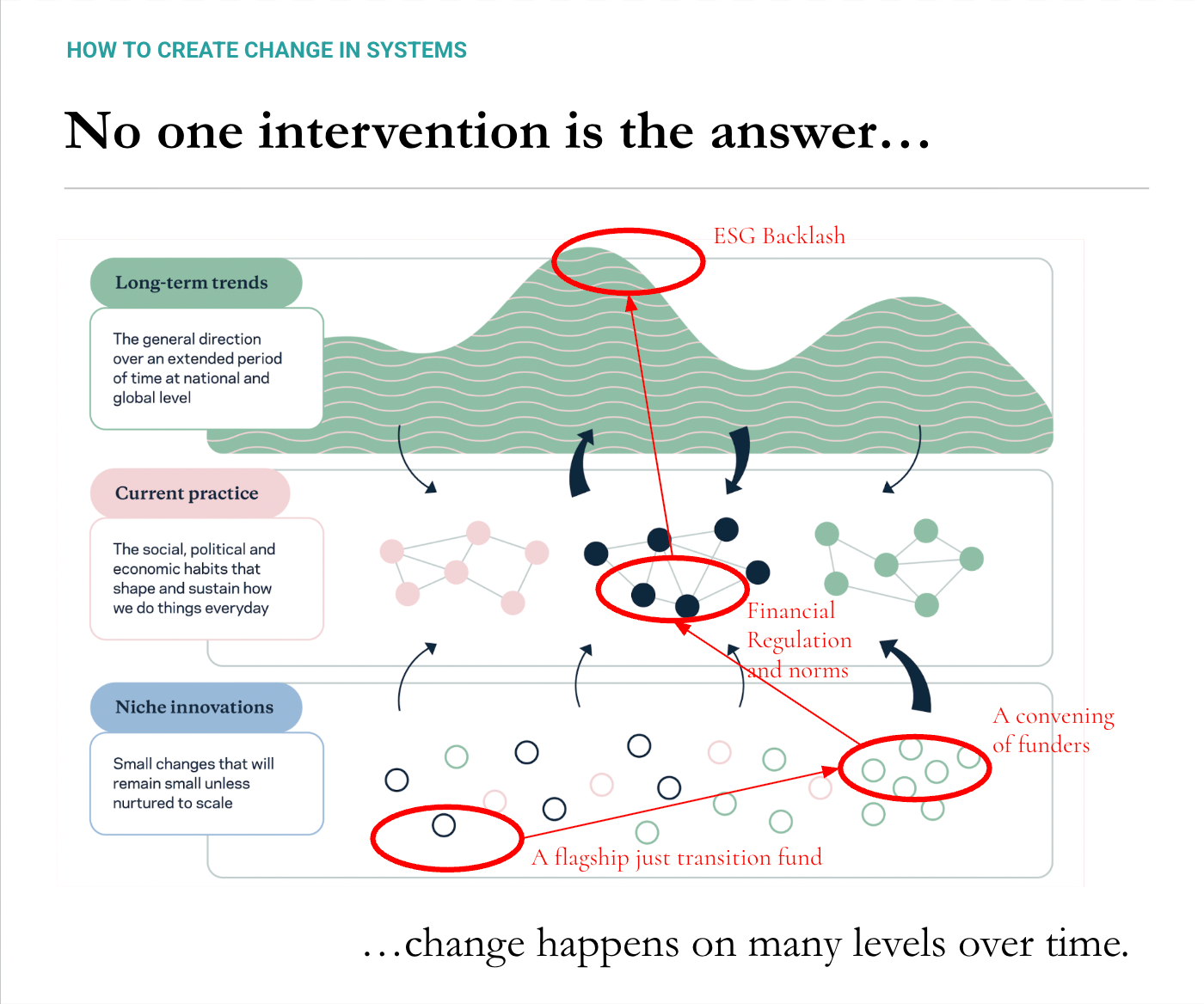

The Multi-Level Perspective (MLP) framework is a powerful way to understand large scale societal transitions over time, but it is also complex. To help others engage with it, we simplified it, so anyone mainstream public or private sector actor can use it. We call it the MLT: Multi-Level Thinking.

Our adapted MLT looks at transitions across 3 levels: Long term trends, current practices and niche innovations. Thinking in this way helps stakeholders quickly see - and make sense of - the combinations of forces and actions that either keep a system locked in its current trajectory or create the conditions for new, transformative pathways to emerge. Because of this, MLT has become a core framework we use to build alignment among the diverse stakeholders involved in this work.

First up, why bonds?

To set the scene, bonds, especially green, social, sustainability, and sustainability-linked bonds (GSS+), hold significant potential to finance just transition outcomes. These include infrastructure, retraining, regional development, and social protection, while also signalling institutional commitment. There are early signs of integration into bond frameworks, but major gaps remain: industry aligning principles, guidance on use of proceeds and reporting, and the underpinning reporting and metrics.

According to Simon Bond and Nick Robins, Co-Chairs of this convening, there are three reasons:

Size: The global bond (fixed income / debt) market dwarfs the equity market in absolute size. Some estimates place global debt markets at ~US $300 trillion compared to global equity markets of roughly US $100–110 trillion (i.e. 2–3× larger).

Voice: While bondholders don’t vote like they can in listed markets, they hold critical influence at the deal structuring stage, giving us the opportunity to shape how proceeds are deployed for just transitions. The primary market is where the capital decisions happen.

Accountability: The fixed income market is nothing if not a fan of precision. Labelled bonds let us follow the money, precisely defining eligible uses and monitoring disbursement over time, so capital can, in theory, measurably reach communities, workers, and transition infrastructure.

Why Multilateral Development Bonds (MDB)?

Yes, MDBs are a comparatively small issuer market segment. Of the US $671b in green bonds issued, just US $67.2b are in the development bank and local government segment.

However, MDBs remain a powerful leverage point for the rest of the issuers to learn from because:

Political alignment: MDBs have already made high-level commitments to the just transition, in that committing to align their financing with the objectives of the Paris Agreement, they acknowledge that sustainable development, climate change and nature loss are interconnected challenges. (JTFL, October 2025)

Operational progress: Comparative to other issuer segments, MDBs are already developing strategies to operationalise their just transition commitments (JTFL, October 2025). While currently fragmented, these are important signals of progressivism against the global ESG backlash we face today.

Leverage potential: MDB’s have historically played an important role in the scale of up new bond labels (e.g. green and social bonds), in that their large issuance values can attract cornerstone thematic investors; which in turn can attract early corporate issuance and signal the need for industry actors to step to align and enable the market more formally.

The method: the power of strategic convenings to create change

Thanks to our collaboration with the Just Transition Finance Lab, we have approached this work in three stages:

Define: Understand the key barriers and opportunities in the landscape

Design: Build an enduring convening model for change

Deliver: Onboard, align and activate the right stakeholders around common priorities

Define phase

Dr Gemma John, leading on our design research, worked closely with the JTFL team, whose recent publications - Headwinds and structural constraints Mapping forces challenging just transition finance (2025) and Multilateral development banks’ use of green, social and sustainability (GSS) bonds: lessons for private investors (2025) - have provided vital context and has helped us create a foundation understanding that the community will sharpen and build into.

Design phase

Charmaine Che, leading on the CoP’s design and delivery model, has drawn from The Together Institute’s convening model, to develop a strategic convening that can (i) bring cornerstone influencers into a core community of practice over time, in order to align and take action on key priorities while (ii) enabling wider adoption through industry led co-design and facilitated adoption circles. If you are curious to know more about this model, dive into a Q&A with Charmaine on how she designed this and plans to deliver it, here.

Delivery phase

This is where the real work begins. To kick start this convening, we are fortunate to have a powerful group of partners uniquely capable of shaping deep, structural change across the sector. Together we are acutely aware of the danger of assumed strategic alignment. As such our 1st deliverable as a community will be a paper to summarise our collective understanding of where MDB issuer and investor practice is right now, and what exactly we plan to do about it to achieve deep and structural change. This will be circulated to strategic funders and we will deliver on our first and most important priority together by YE 2026.

What next?

At 103, we believe in working out loud - sharing our insights, our progress and our stumbles along the way. If you’d like to follow on our journey and be in receipt of our first deliverable, sign up to our newsletter below.